In today's rapidly evolving financial landscape, compliance is more critical than ever. For businesses in the Banking, Financial Services, and Insurance (BFSI) sector, as well as fintech companies, adhering to regulatory requirements is essential not only for avoiding penalties but also for maintaining market confidence and trust. The introduction of COMPASS, an all-in-one solution for comprehensive compliance management, represents a significant advancement in how these organizations can manage their compliance obligations efficiently and effectively. This article explores the importance of compliance in the BFSI and fintech sectors and how COMPASS can streamline this process.

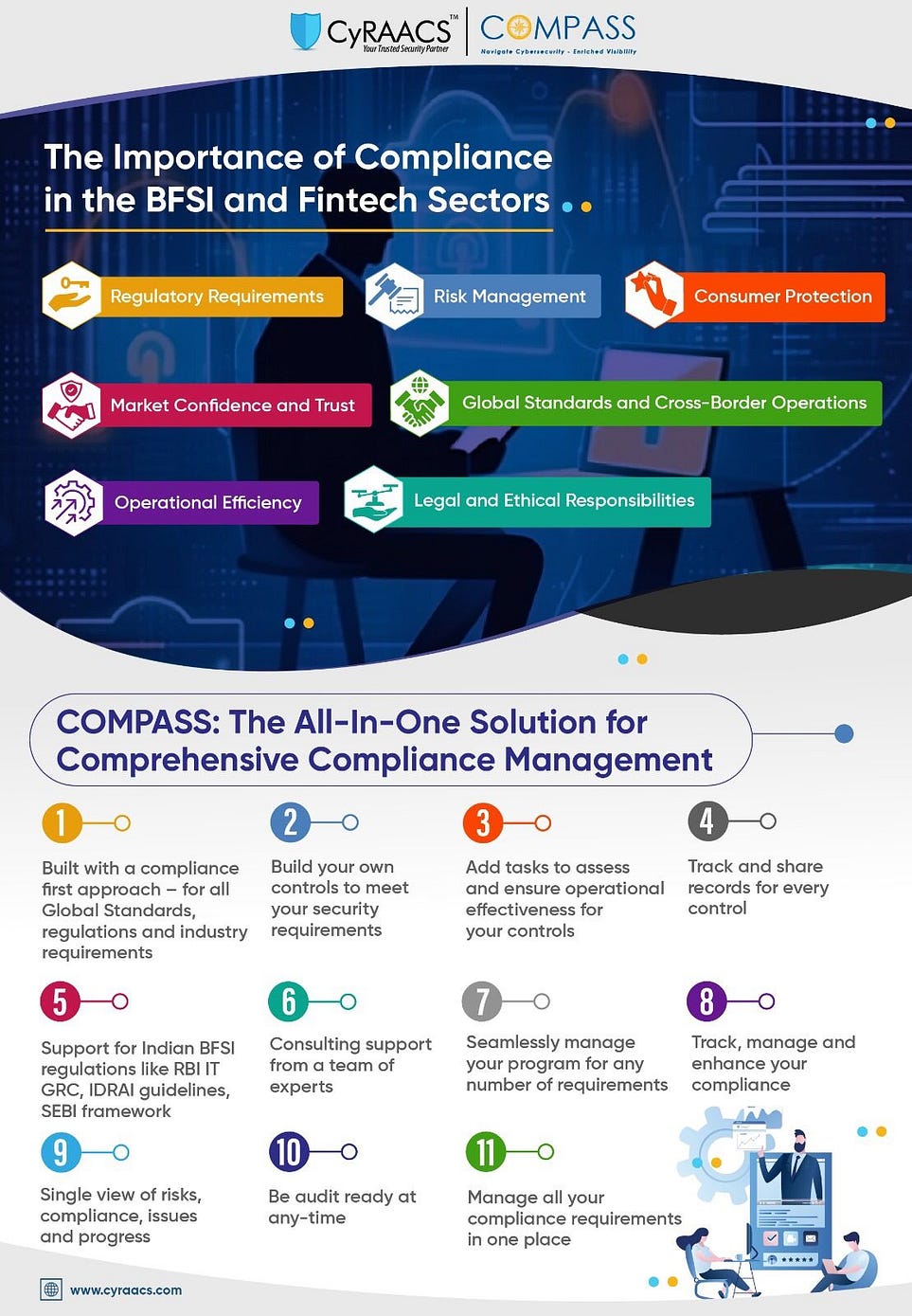

The Importance of Compliance in BFSI and Fintech

Compliance in the BFSI and fintech sectors encompasses a broad range of regulatory requirements designed to ensure the stability and integrity of the financial system. These regulations cover areas such as risk management, consumer protection, market confidence, and operational efficiency. Compliance is not just about adhering to legal requirements; it is about fostering a culture of ethical behavior and accountability within the organization.

Regulatory Requirements

Regulatory requirements are the foundation of compliance in the BFSI and fintech sectors. These regulations are designed to protect consumers, ensure fair practices, and maintain the stability of the financial system. Non-compliance can result in severe penalties, reputational damage, and even the revocation of operating licenses. Therefore, organizations must haverobust compliance management systems in place.

Risk Management

Effective risk management is a critical component of compliance. Financial institutions and fintech companies must identify, assess, and mitigate various risks, including operational, financial, and reputational risks. Compliance with risk management regulations helps organizations minimize potential losses and protect their assets.

Consumer Protection

Protecting consumers is a primary objective of many regulatory frameworks. This includes ensuring transparency in financial transactions, safeguarding personal data, and preventing fraudulent activities. By adhering to consumer protection regulations, organizations can build trust and loyalty among their customers.

Market Confidence and Trust

Compliance with regulations helps maintain market confidence and trust. Investors and stakeholders are more likely to engage with organizations that demonstrate a commitment to regulatory compliance. This trust is essential for the long-term success and sustainability of any financial institution or fintech company.

Operational Efficiency

Operational efficiency is another key benefit of compliance. By implementing standardized processes and controls, organizations can streamline their operations, reduce redundancies, and improve overall productivity. This efficiency can lead to cost savings and better resource allocation.

Introducing COMPASS: The All-in-One Solution for Compliance Management

COMPASS is designed to address the multifaceted compliance needs of the BFSI and fintech sectors. It offers a comprehensive suite of tools and features that enable organizations to manage their compliance obligations seamlessly. Here's how COMPASS can help streamline compliance:

1. Built with a Compliance-First Approach

COMPASS is built with a compliance-first approach, ensuring that it aligns with all global standards, regulations, and industry requirements. This means that organizations can rely on COMPASS to help them meet their compliance obligations across different jurisdictions and regulatory frameworks.

2. Customizable Controls

With COMPASS, organizations can build their controls to meet specific security and compliance requirements. This flexibility allows companies to tailor their compliance management processes to their unique needs, ensuring that all regulatory obligations are met.

3. Task Management and Operational Effectiveness

COMPASS includes features for task management and operational effectiveness. Organizations can add tasks to assess and ensure the effectiveness of their controls. This proactive approach helps in identifying and addressing potential compliance issues before they escalate.

4. Comprehensive Tracking and Reporting

One of the standout features of COMPASS is its ability to track and share records for every control. This comprehensive tracking ensures that organizations have a clear view of their compliance status at all times. Detailed reporting capabilities also provide valuable insights into compliance performance and areas for improvement.

5. Support for Indian BFSI Regulations

For organizations operating in India, COMPASS offers support for specific regulations such as RBI IT GRC, IDRAI guidelines, and the SEBI framework. This localized support ensures that companies can meet their compliance obligations in the Indian market effectively.

6. Expert Consulting Support

COMPASS provides consulting support from a team of experts. This support is invaluable for organizations that may need guidance on complex compliance issues or assistance in developing and implementing their compliance strategies.

7. Seamless Program Management

Managing a compliance program can be challenging, especially for organizations with multiple requirements. COMPASS allows for seamless management of compliance programs, ensuring that all regulatory obligations are met without unnecessary complexity.

8. Enhanced Compliance Tracking

COMPASS includes advanced features for tracking, managing, and enhancing compliance. Organizations can monitor their compliance status in real-time and make data-driven decisions to improve their compliance posture.

9. Single View of Risks and Compliance

With COMPASS, organizations can achieve a single view of risks, compliance issues, and progress. This holistic view enables better decision-making and more effective risk management.

10. Audit Readiness

Being audit-ready at any time is crucial for compliance. COMPASS helps organizations maintain their audit readiness by ensuring that all compliance records are up-to-date and easily accessible.

11. Centralized Compliance Management

COMPASS allows organizations to manage all their compliance requirements in one place. This centralization simplifies the compliance management process and reduces the risk of oversight.

Benefits of Using COMPASS for Compliance Management

The implementation of COMPASS offers numerous benefits for organizations in the BFSI and fintech sectors. Here are some of the key advantages:

Improved Efficiency

By streamlining compliance processes, COMPASS helps organizations improve their operational efficiency. This efficiency can lead to significant cost savings and better resource allocation.

Enhanced Risk Management

COMPASS provides organizations with the tools they need to identify, assess, and mitigate risks effectively. This proactive approach to risk management helps minimize potential losses and protect the organization's assets.

Better Compliance Tracking

With comprehensive tracking and reporting features, COMPASS ensures that organizations have a clear view of their compliance status at all times. This transparency is essential for maintaining compliance and addressing any issues promptly.

Increased Market Confidence

By demonstrating a commitment to regulatory compliance, organizations can enhance market confidence and trust. This trust is crucial for attracting investors and maintaining long-term sustainability.

Simplified Audit Processes

COMPASS simplifies the audit process by ensuring that all compliance records are up-to-date and easily accessible. This audit readiness is essential for avoiding penalties and maintaining a good standing with regulators.

Implementing COMPASS: Best Practices

To maximize the benefits of COMPASS, organizations should follow best practices for implementation. Here are some tips for successful implementation:

1. Conduct a Compliance Assessment

Before implementing COMPASS, conduct a thorough compliance assessment to identify your organization's specific needs and requirements. This assessment will help in tailoring COMPASS to your unique compliance obligations.

2. Engage Key Stakeholders

Engage key stakeholders, including senior management, compliance officers, and IT teams, in the implementation process. Their involvement is crucial for ensuring that COMPASS is integrated effectively into your organization's compliance framework.

3. Provide Training

Provide comprehensive training to all users of COMPASS. This training should cover the system's features, how to use it effectively, and best practices for compliance management.

4. Monitor and Review

Continuously monitor and review the performance of COMPASS. Regular reviews will help in identifying any issues and making necessary adjustments to improve the system's effectiveness.

5. Leverage Expert Support

Take advantage of the consulting support offered by COMPASS. These experts can provide valuable insights and guidance on complex compliance issues and help in developing effective compliance strategies.

Conclusion

In the BFSI and fintech sectors, compliance is not just a regulatory requirement but a cornerstone of building trust, managing risks, and ensuring operational efficiency. COMPASS offers a comprehensive solution for managing compliance, equipping organizations with the necessary tools to meet their regulatory obligations effectively. By implementing COMPASS, businesses can streamline their compliance processes, enhance risk management capabilities, and maintain market confidence and trust. As a leading cybersecurity company, CyRAACS provides the expertise and solutions needed to navigate the complexities of compliance, ensuring that organizations remain secure and compliant in an ever-evolving financial landscape.

Source: https://medium.com/@cyraacs/streamlining-compliance-for-bfsi-and-fintech-with-compass-b280e277fbf6